cryptocurrency tax calculator uk

Any gains or losses made from a crypto asset held for longer than a year incurs a tax of 0 15 or 20 depending on individual or combined marital income. You can also generate an Income report that shows your income from Mining Staking Airdrops Forks etc.

For individuals income tax supersedes capital gains tax and applies to profits.

. How to calculate cost basis according to rules for share identification the 30-day rule bed and breakfasting and Section 104 holding. Your cryptocurrency tax rate on federal taxes will be the same as your capital gains tax rate. Learn how cryptocurrencies are taxed in your country.

For that please consult a financial adviser or tax consultant. Capital Gains Tax is a tax you pay on your profits. You simply import all your transaction history and export your report.

Create your free account now. Amount and currency of the coin or token sold Fiat value at the time of acquisition. Detailed case studies tutorials.

If your capital losses exceed your capital gains the amount of any excess loss that you can claim. The rate you pay on crypto taxes depends on your taxable income level and how long you have held the crypto. As a refresher short-term capital gains had a rate of 10 to 37 in 2021 while long-term capital gains had a rate of 0 to 20.

The rate of CGT that you pay each year depends on the asset youve sold and how much you earn. Youll then need to file and pay your Capital Gains Tax bill by 31st January each tax year. Use your tokens to pay for goods or services.

It should be clear now that cryptocurrency tax calculations can be quite complicated but the most important thing to do is to keep track of all the transactions on different. This means you can get your books up to date yourself allowing you to save significant time and reduce the bill charged by your accountant. We are proud to be hosting an online seminar.

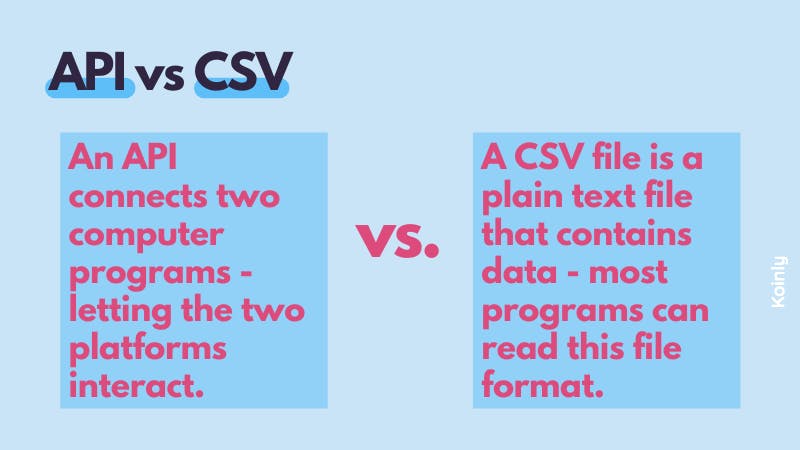

Crypto bitcoin united-kingdom tax cryptocurrency tax-calculator hmrc cryptoasset capital-gains tax-calculations cryptotax tax-reports Resources. Crypto tax calculator software lets the users connect or import their cryptocurrency transaction data mainly the purchase price sale price and the crypto tax calculator tool automatically provides the gains or loss and other relevant information to populate your tax reports. Capital Gains in UK.

The cryptocurrency tax calculator handles this automatically using your investment and trading history. This site aims to provide a simple overview of UK tax rules for newcomers to bitcoin and cryptocurrency. You might need to pay Capital Gains Tax when you.

HMRC also suggests what cost you can deduct from disposal proceeds to calculate capital gain. Although all information provided has been verified in communication with HM Revenue. Additionally for each sale or exchange you will need the following information.

To calculate your capital gains as an individual the HMRC requires you to keep track of your average cost basis for the token on hand aggregate your same-day transactions and ignore any wash sales. 10 to 37 in 2022 depending on your federal income tax bracket. Short-term capital gains are dependent on your tax bracket which ranges from 10 to 37.

It takes less than a minute to sign up. Yes CryptoTaxCalculator is designed to generate accountant friendly tax reports. Best Crypto Tax calculator in the UK.

You can discuss tax scenarios with your accountant. Crypto-currency tax calculator for UK tax rules. Exchange your tokens for a different type of cryptoasset.

Youll need your transaction history in order to track your tax lots. Calculating cryptocurrency in the UK is fairly difficult due to the unique rules around accounting for capital gains set out by the HMRC. For companies profits or losses from cryptocurrency trading are part of the trading profit rather than a chargeable gain.

When to check. Short-term crypto gains on purchases held for less than a year are subject to the same tax rates you pay on all other income. You declare anything youve earned from selling an asset over a certain threshold via a tax return.

Koinly helps UK citizens calculate their crypto capital gains. Latest news and advice on cryptocurrency taxes. HMRC has published guidance for people who hold cryptoassets or cryptocurrency as they are also known explaining what taxes they may need to pay and what records they need to keep.

See the full HMRC guidance here.

Cryptocurrency Tax Calculator Forbes Advisor

Top 10 Uk Exchanges To Get Crypto Tax Reports Koinly

Calculateme Com Calculate Just About Everything Area Of A Circle Gas Mileage Calculator

Add Your Sources Of Cryptocurrency Income From The Tax Year Tax Software Cryptocurrency Taxact

How To Calculate Your Uk Crypto Tax

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Top 10 Uk Exchanges To Get Crypto Tax Reports Koinly

Cryptocurrency Tax Guides Help Koinly

Bitcoin Taxes Crypto Portfolio Prices Cointracker

Top 10 Uk Exchanges To Get Crypto Tax Reports Koinly

How To Calculate Crypto Taxes Koinly

Declare Your Bitcoin Cryptocurrency Taxes In Uk Hmrs Koinly

10 Best Crypto Tax Software Solutions 2022 Reviews Fortunly

Best Crypto Tax Software Top Solutions For 2022